how to open tax file malaysia

Fill in the required information. However if you havent registered a tax file and your income is below the chargeable amount you dont need to register a tax file.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

The following entities and accounting firms in Malaysia must file their taxes.

. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Tax filing depends on how you registered your business.

Double-check each employees Borang E to ensure that everything is in place. You are liable to file your the. Income generated from freelancing reviews brand endorsements and social media promotion are subject to income tax as stated by The Inland Revenue Board of Malaysia Lembaga Hasil Dalam Negeri LHDN.

2Only gif File Format is allowed and the file size must be from 40k and not more than 300k. Each spouse earning Taxable income can claim personal tax relief of RM 8000 by filling separate tax returns. In a statement it said the submission of tax return forms through e-filing for Forms E BE B M BT MT P TF and TP can be made through the official HASiL portal.

An e-Daftar application will be cancelled if complete documents are not received within 14 days from the date of application and an applicant must make a new. 2 File Separate tax returns. The process of registration is discussed below.

How to Register a tax file in Malaysia. With Talenox Payroll you can submit Borang E in just 3 steps. Once you do this your e-Filing account digital certificate will be registered may proceed to complete the ITRF through ezHASiL e-Filing.

Bring along your supporting documents. The tax year runs from 1 January to 31 December. Once you have completed and uploaded the required documents click Submit and LHDN will provide a Pin Number for you to review the application after 7 working days.

Fill in your tax reliefs tax rebates. The deadline for tax returns for salaried individuals those who dont run a business is 31st March. Browse to ezHASiL e-Filing website and click First Time Login.

This can be done at the nearest SSM office or via their online portal. If it continues you will be fined another 5. If youd like to retrieve it online head over to the LHDN Maklum Balas Pelanggan Customer Feedback website.

Mulai 18 Mac 2019 Lembaga Hasil Dalam Negeri Malaysia LHDNM tidak lagi menerima permohonan untuk Sijil Taraf Orang Kena Cukai STOKC. At the IRB office ask for the form to register a tax file. Individual who has income which is taxable.

You can register your tax file online. Register for first-time taxpayer online via LHDN MalaysiaA Go to e-Filing website. Head over to Payroll Payroll Settings Form E.

You will then be asked to fill in an online form and upload some verification documents. In a statement it said the submission of tax return forms through e-filing for Forms E BE B M BT MT P TF and TP can be made through the official HASiL portal. Lanjutan daripada itu pengeluaran STOKC juga akan diberhentikan.

How to File Income Tax in Malaysia 2021 LHDNAre you filing your income tax for the first time. A business or company which has employees and fulfilling the criteria of registering employer tax. A separate assessment allow each spouse to claim personal tax relief of RM 8000 while a joint tax return allows one spouse to claim a wife or husband relief of RM 3000.

Submit the form along with a copy of your identification MyKad or other IDs and your salary details EAEC Of course you can also register using the. A list of offices and branches where you can register is available on the Inland Revenue Board of Malaysia website. Youll need to submit a completed Business Registration Form Form A along with a photocopy of your NRIC permit or supporting letters if any and the required payment.

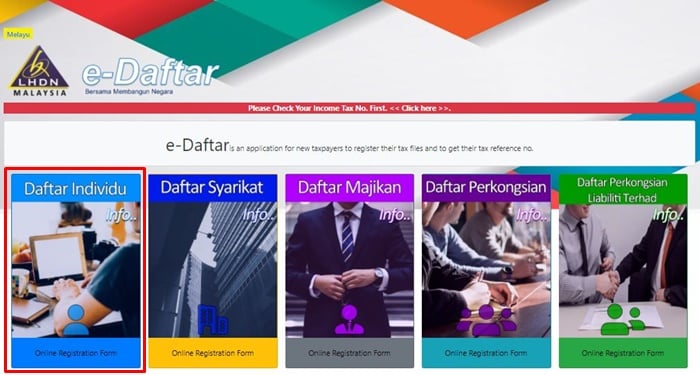

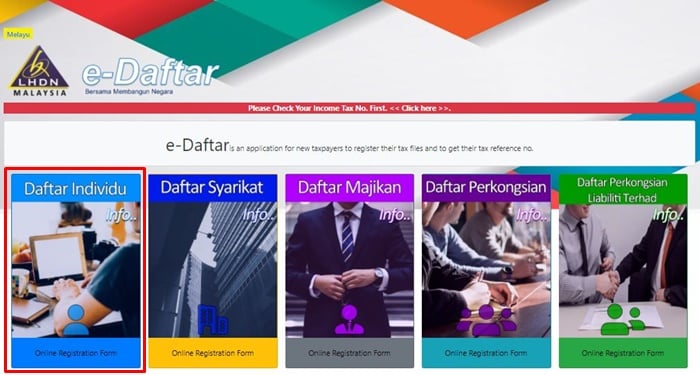

Click on Permohonan or Application depending on your chosen language. Online submissions of tax returns for 2021 will be accepted beginning March 1 the Inland Revenue Board LHDN said today. Here is the step-by-step guide for the e-Filing process.

The process is simple and wont take you more than two hours to complete. A businessperson with taxable income. 3 File name must only contain Alphanumeric Characters a-z A-Z and 0-9.

Make sure your email address is correct because LHDN will send a reference number to your email. How to open tax file malaysia. Review all the information click Agree Submit button.

2Only gif File Format is allowed and the file. Click on e-Filing PIN Number Application on the left and then click on. If you submit late within the first 60 days you will need to pay 10 more than the tax payable as a fine.

Remember you need to register as taxpayers while registering for ezHASiL e-Filing. Fill up PIN Number and MyKad Number click Submit button. If you registered as an LLP or Sdn.

If you registered under sole prop or partnership then income tax is combined between your personal and business. You must be wondering how to start filing income tax for the. Bhd then you will need to.

If you have never filed your taxes before on e-Filing income tax Malaysia 2022 go to httpsedaftarhasilgovmy and click on the Daftar Individu button. Unregistered companies with IRBM. Click on Generate Form E for 2020.

Anyone earning above RM34000 before EPF deductions for this period needs to submit a tax return to LHDN. Choose the right income tax form. Taxpayers are advised to submit their.

Fill in your income details. Once that is done click on Download Form E sign and submit via E-Filing. Fill up this form with your employment details.

Login to e-Filing website. Check your personal details. First of all you need to register at the ezHASiL e-Filing website.

An employee who is subject to monthly tax deduction. Now income tax registration is much easier than before. Untuk makluman STOKC adalah pengesahan yang dikeluarkan oleh LHDNM ke atas status seseorang yang dikenakan cukai di Malaysia.

March and April is tax filing season in Malaysia. According to Section 1121 of the Income Tax Act 1967 an individual can be imprisoned up to six months or fined up to RM2000 whenever he or she fails to furnish an income tax return form. In-person registration is available at any Inland Revenue Board of Malaysia office or Urban Transformation Centre UTC branch.

Tax Guide For Expats In Malaysia Expatgo

How To File Your Taxes For The First Time

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Individual Income Tax In Malaysia For Expatriates

Guide To Using Lhdn E Filing To File Your Income Tax

How To File Your Taxes For The First Time

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

7 Tips To File Malaysian Income Tax For Beginners

7 Tips To File Malaysian Income Tax For Beginners

Tax Guide For Expats In Malaysia Expatgo

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Income Tax Malaysia 2018 Mypf My

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Guide 2021 Ya 2020

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star